The Madison System Maintains a library of over 150 reports from which client’s may select those that are the most useful. Users can employ Madison’s leading edge technology for comprehensive, highly flexible and convenient presentation-ready reporting. Madison Reports are easily accessible and allow users to slice and dice data with remarkable ease.

The Madison System Maintains a library of over 150 reports from which client’s may select those that are the most useful. Users can employ Madison’s leading edge technology for comprehensive, highly flexible and convenient presentation-ready reporting. Madison Reports are easily accessible and allow users to slice and dice data with remarkable ease.

Reports include powerful tools that allow users to group, sort, filter and manipulate data so it can be presented in the most meaningful manner. Each Report includes a graph, summary table and detailed listing of each loan. Users can drill down to view and print details about each loan, collateral, and borrower. Reports can be exported to Excel so you can further manipulate the data, to PDF format to be saved or emailed, to Word or to a variety of other file formats.

Information within many reports can be grouped by user-selections such as loan type, collateral type, market, lending officer, lending office, and more. Information within groups can be listed based on user-selections such as loan balance, loan name, loan number, and more. Users can filter the contents of many reports to include, for example, only data newer than (or older than) a specified date or with ratios better than (or worse than) a user-specified threshold. Or loans of specified collateral, or loans or specified loan officers, and much more.

Reporting is easy and comprehensive with the Madison System™.

Some of the key features of Madion Reports are listed below.

Loan Filtering

Use powerful filters to quickly and easily focus on small groups of loans that may be of special interest. For example, you can select loans of a particular collateral type, or in particular market, or with weak performance ratios. Or find all loans with collateral occupied by a user-selected tenant.

Automatic Report Distribution

Automatically distribute any report (or group of reports) by e-mail to selected officers on a scheduled basis (daily, weekly, monthly) to alert them to important information. For example, you can distribute a loan delinquency report every Monday morning to each loan officer, listing their delinquent loans.

Stress Test Analysis

Stress loans according to your pre-defined parameter values to verify their ability to withstand adverse environments. Estimate defaults, extensions, losses and loan loss reserves. Project losses over a 10-year time horizon based on a sophisticated set of user-specified assumptions.

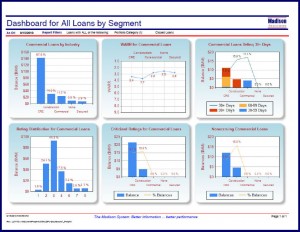

Dashboard Reports

Dashboard reports for presentation to Senior Management and the Board provide a comprehensive graphical presentation of the current credit quality of the total portfolio and by segment. Dashboard Reports also show how the portfolios’ credit quality has changed over time.

Loan Committee Presentations

Display reports of all the loan and collateral information from the System that you want to present to the loan committee, including the financial terms of the loan; collateral information and history; financial statement history; borrower, guarantor and sponsor information, and much more. Use reports from Madison’s library or custom reports tailored to your requirements.

Stratification Reports

Use the highly efficient portfolio stratification system to stratify the portfolio on nearly any field including those that are dollar values, dates, ratios or text (e.g., collateral type or state). For fast reporting, users may select the number of strata to display and the report will automatically create the break points.

Accounting Reports

View special reports that list classified assets, delinquent loans, FASB 114 loans, watch list loans, and many more. Use stress test report to evaluate and support loan loss reserves, or market value reports for financial statement purposes.

Loan Production

Instantly create reports that measure how loans are progressing through the pipeline. Production reports may be shared online by all authorized personnel, or distributed by e-mail.

Measure Origination Productivity

Measure the time require to originate each loan. Eliminate bottlenecks by identifying loans that are taking too long to process. Monitor why loans were lost so you can quickly respond to changing market conditions.

Trend Reports

Show portfolio trends over time such as loan origination volume by year or year-to-date, loan origination credit quality measures, or more. Monitor portfolio trends quickly and easily.

Maintain Timely and Accurate Information

Use the built-in features to identify stale or inconsistent data to help you maintain timely and accurate information. Keep important data current with less effort.

Custom Reports

You can also take advantage of custom reports just for your organization. Custom reports can be variations on the current Madison library of reports, or completely new reports just for your organization.